Fast Economic Calendar for Forex Trading

Introduction

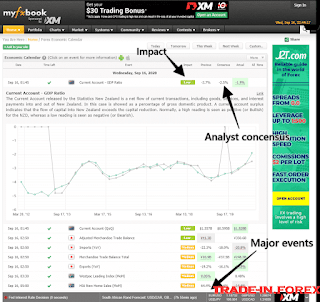

In the world of forex trading, staying updated with the latest economic data and events is crucial. Economic indicators and events have a significant impact on currency pairs, influencing their volatility and direction. Traders who possess accurate and timely information usually make more informed decisions, leading to better trading outcomes. Therefore, utilizing a fast economic calendar specifically designed for forex trading can be incredibly beneficial in this dynamic market.

Why You Need a Fast Economic Calendar

A fast economic calendar provides traders with real-time updates on economic indicators and events from around the world. By using a reliable economic calendar, forex traders can anticipate market movements, make precise predictions, and develop effective trading strategies. Here are three key reasons why having a fast economic calendar is essential:

-

Stay Informed

The forex market operates 24 hours a day, five days a week. Economic events, such as interest rate decisions, GDP releases, employment reports, and political developments, can occur at any time. A fast economic calendar helps you stay informed about upcoming events, allowing you to adjust your trading approach accordingly. By keeping track of these events, you can avoid unexpected surprises and cater your trading decisions to the market conditions.

-

Seize Opportunities

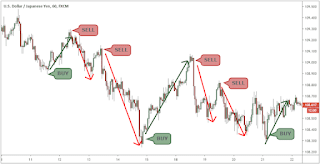

Certain economic events have a significant impact on specific currency pairs. For example, a positive employment report can strengthen a country's currency, leading to potential trading opportunities. By utilizing a fast economic calendar, you can identify such events quickly and take advantage of the resulting price fluctuations. With timely access to economic data, you can enter and exit trades at the most opportune moments, maximizing your chances of profitability.

-

Manage Risk

Economic indicators can cause volatility in the forex market, which can be both advantageous and risky. By staying up-to-date with economic events through a fast economic calendar, you can proactively manage your risk. For instance, if a significant economic announcement is looming, you may choose to reduce your position sizes or set specific risk management parameters to minimize potential losses. The ability to control risk is crucial for long-term success in forex trading.

Choosing the Right Fast Economic Calendar

With an abundance of economic calendars available online, selecting the right one that suits your trading needs is essential. Here are a few factors to consider:

- Reliability and Accuracy: Choose an economic calendar from reputable sources to ensure the data is reliable and accurate.

- Real-time Updates: The calendar should provide real-time updates as soon as economic events occur.

- User-friendly Interface: Opt for an economic calendar that is easy to navigate and understand.

- Customization Options: Look for a calendar that allows you to filter and customize data based on your preferences.

- Mobile Accessibility: Consider choosing a calendar that offers a mobile app for on-the-go access.

Selecting the right economic calendar will enable you to make informed decisions and enhance your trading experience.

Conclusion

A fast economic calendar tailored for forex trading provides traders with updated and relevant information to make informed decisions. By staying informed about economic indicators and events in real-time, traders can seize opportunities and manage risk effectively. Take the time to choose a reliable economic calendar that suits your needs and trading style to enhance your chances of success in the forex market.